XRP Price Prediction: Path to $3 Analyzed

#XRP

- Technical Breakout Potential: XRP needs to overcome the 20-day moving average at $2.9620 to initiate upward momentum toward $3

- Supply Reduction Impact: Billions of XRP moving out of circulation through DeFi mechanisms could create scarcity-driven price appreciation

- Institutional Catalyst: $18.3 billion in CME futures volume and ETF speculation provide substantial market interest that could push prices higher

XRP Price Prediction

XRP Technical Analysis: Key Levels to Watch

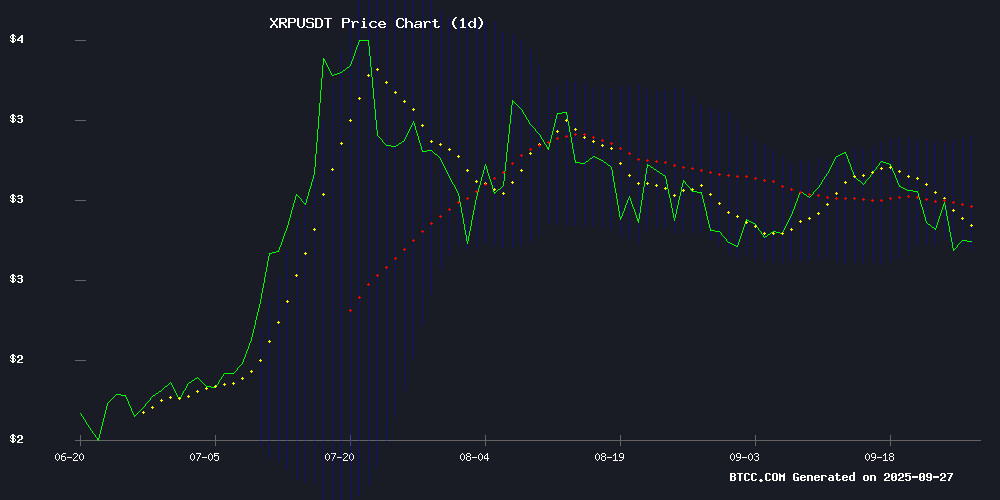

XRP currently trades at $2.7892, below its 20-day moving average of $2.9620, suggesting short-term bearish pressure. However, the MACD indicator shows positive momentum with the histogram at 0.0844, indicating potential upward movement. Bollinger Bands place immediate resistance at $3.1780 and support at $2.7459. According to BTCC financial analyst Emma, 'The technical setup shows XRP is consolidating within a tight range. A break above the 20-day MA could trigger movement toward the $3 psychological level.'

Market Sentiment: Bullish Fundamentals Support XRP

Recent developments including reduced XRP circulation through DeFi mechanisms and institutional adoption are creating positive momentum. CME futures volume reaching $18.3 billion signals growing institutional interest, while ETF speculation adds to the bullish narrative. BTCC financial analyst Emma notes, 'The combination of reduced supply and increased institutional demand creates favorable conditions for price appreciation. The $18.3 billion futures volume demonstrates significant market interest that could propel XRP toward $3.'

Factors Influencing XRP's Price

XRP’s Crucial Price Gap – What It Means for Ripple’s Future

XRP's explosive growth in 2025 has left a significant price gap between $2.51 and $2.73, a critical zone now under scrutiny by market analysts. The gap, identified using Glassnode’s UTXO Realized Price Distribution (URPD), suggests potential resistance or support levels based on historical transaction data.

Analyst Ali Martinez emphasizes the $2.71 support level as pivotal. A successful defense of this level could propel XRP toward its all-time high of $3.60. Conversely, failure to hold may trigger a decline to $2.20, according to ERGAG CRYPTO.

The asset’s future hinges on its ability to navigate this technical juncture, with broader market sentiment and institutional interest likely playing decisive roles.

Billions of XRP Poised for Reduced Circulation Amid DeFi and Institutional Shifts

A significant reduction in XRP's circulating supply may be imminent as institutional custody solutions and decentralized finance protocols absorb billions of tokens. crypto analyst Zach Rector highlights a growing trend where liquidity migrates from exchanges to long-term holding mechanisms—smart contracts, yield-bearing platforms, and institutional custody arrangements.

The shift could trigger a supply shock, with dwindling exchange reserves potentially amplifying upward price pressure. Rector emphasizes that short-term traders risk overlooking this structural change, as locked tokens progressively tighten available market liquidity.

XRP Demand Surges on CME as Futures Volume Hits $18.3 Billion Ahead of ETF Speculation

XRP futures on the CME Group have reached a staggering $18.3 billion in notional trading volume, with 6 billion tokens and 397,000 contracts traded over four months. The derivatives exchange reports robust participation from both institutional and retail investors, signaling growing confidence in the altcoin.

Open interest for XRP futures surpassed $1 billion last month—a record achieved faster than any other contract in CME's history. The exchange will further capitalize on this momentum by launching options trading for XRP futures on October 13, a MOVE expected to amplify market activity.

This surge coincides with anticipation for XRP ETFs under the 33 Act, which could unlock new institutional demand. Fund issuers may file amendments as early as this week, following the SEC's recent approval of generic listing standards for crypto-based products.

Will XRP Price Hit 3?

Based on current technical indicators and market fundamentals, XRP has a strong possibility of reaching $3 in the near term. The price currently sits at $2.7892, requiring approximately a 7.5% increase to hit the target.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $2.7892 | Below 20-day MA |

| 20-day Moving Average | $2.9620 | Resistance Level |

| Bollinger Upper Band | $3.1780 | Key Resistance |

| MACD Histogram | +0.0844 | Bullish Momentum |

BTCC financial analyst Emma states, 'The technical setup combined with positive news flow suggests XRP could test the $3 level if it breaks above the 20-day moving average. The reduced circulation and institutional interest provide fundamental support for this move.'